BRYN MAWR, PA (October 15, 2020) — Spouting Rock Asset Management, LLC, (Spouting Rock) a multi-boutique manager platform providing investment solutions and services, proudly celebrates the three-year anniversary of its Small Cap Growth SMA, managed by James Gowen, CFA, and John Ragard, CFA. The strategy was introduced on September 30, 2017 in an incubation stage.

“When launched, we set out to build a portfolio of Sustainable Future Compounders, companies that we felt to be forward-thinking and making positive sustainable business improvements,” said Small Cap Growth CIO and lead portfolio manager, James Gowen. “Our refined investment approach allowing us to focus on selecting progressive companies, combined with our thoughtful portfolio construction process, has helped to provide we what consider to be strong returns since inception.”

Small Gap Growth portfolios, available as Focused or Concentrated, are built from the bottom up, diversified by sector, industry and characteristics to capture long-term growth resulting in a higher active share. Small Cap Growth is ESG-aware and uses it as a risk metric to provide additional insight into the companies owned. Portfolios are accessible through various platforms providers.

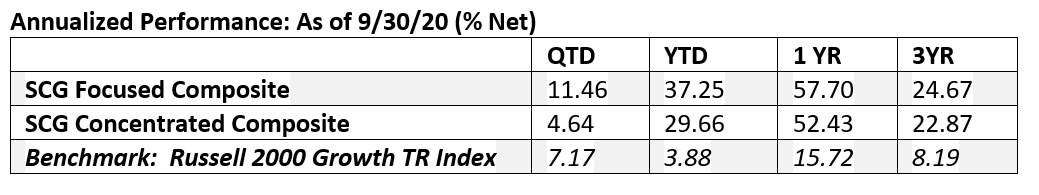

“We are proud of what Small Cap Growth Focused and Concentrated have achieved to date and believe that they provide a unique opportunity for investors, outperforming the benchmark for 10 out of 12 quarters, with attractive upside captures of 136 and 131, respectively, and downside captures of 100 and 91, respectively, since inception,” said Spouting Rock Asset Management CEO, Andrew Smith. “This milestone further solidifies our forward movement in the small cap space and the growth of our multi-boutique manager platform.” The small cap suite consists of an array of offerings from Spouting Rock Asset Management as well as its affiliate, Copper Rock Capital Partners LLC.

“With this continued growth also comes the expansion of our distribution team as we welcome Brian Haskin,” said Spouting Rock Distribution managing member, James Wylie. Haskin brings over three decades of global sales and management experience from firms including Analytic Investors, Barclays Global Investors, Wilshire Associates and Alternative Strategy Partners. “Brian’s depth of experience and relationships will be critical in bringing the small cap suite to the marketplace and furthering the Spouting Rock brand.”

###

About Spouting Rock Asset Management

Founded in 2018, Spouting Rock Asset Management is a multi-boutique manager platform providing alternative, traditional, and thematic investment solutions and services located outside of Philadelphia, PA. We’re an active investment manager providing sophisticated investors, financial professionals and institutions with strategies designed to help them plan for their financial future. As a fiduciary, every decision we make is intended to be in the best interests of our clients. Utilizing a thematic investing approach to build solutions allows us to align with what drives our clients.

Disclosure

The Spouting Rock Small Cap Growth Composite (“Spouting Rock Small Cap Growth”) contains only fully discretionary, fee and non-fee-paying accounts. Investment advice is offered through Spouting Rock Asset Management, LLC which is registered as an investment advisor with the SEC and only transacts business in states where it is properly registered or is excluded or exempted from registration requirements. SEC registration does not constitute an endorsement of the firm by the SEC nor does it indicate that the advisor has attained a particular level of skill or ability. Please contact Michael Hullings at mhullings@spoutingorck.us for additional composite information. Past performance is not indicative of future results. Holdings, allocations and characteristics are disclosed at the beginning of each quarter. Any model, graph or chart used has inherent limitations on its use and should be relied upon for making any investment decisions. Nothing herein should be construed to be an offer, or a solicitation of any offer, to invest in or buy an interest in any investment vehicle managed by Spouting Rock. The investment management fee schedule for the Spouting Rock Small Cap is 0.85%. The separate account minimum account size for this strategy is $150,000. The U.S. Dollar is the currency used to express performance. Returns are presented net of management fees and include the reinvestment of all income. Performance was calculated using actual management fees. Additional information regarding the policies for calculating and reporting returns is available upon request. The Russell 2000 Growth Index measures the performance of the Russell 2000 companies with higher price to book and higher forecasted growth rates. The Russell indices are trademarks of the London Stock Exchange companies, the indices are unmanaged and are not available for investment and do not incur expenses. Upside/downside capture ratios show how the fund has outperformed the broad market benchmark during periods of market strength and weakness. An upside capture ratio of over 100 indicates a fund has generally outperformed the benchmark during periods of positive returns for the benchmark. Downside capture of less than 100 indicates that a fund lost less than its benchmark in periods of red for the benchmark.

Certain information contained in this document constitutes a “forward-looking statement,” which can be identified by the use of forward-looking terminology, such as “may,” “will,” “seek,” “should,” “expect,” “anticipate,” “estimate,” “intend,” “continue,” “believe,” or the negatives thereof or other variations thereof or comparable terminology. Due to various risks and uncertainties, actual events or results or the actual performance may differ materially from those reflected or contemplated in such forward-looking statements, including a complete loss of investment. Any sectors or industries or companies mentioned should not be perceived as investment recommendations. Any securities discussed may no longer be held in the portfolio. Information presented is believed to be factual and up-to-date and was obtained from sources believed to be reliable. For a list of Portfolio holdings, standard Fee schedule or to request a presentation and/or a copy of SRAM’s Form ADV Part 2A please contact Michael Hullings at mhullings@spoutingrock.us.